Thematic Funds & ETFs | Exciting Stuff, but not for Everyone

During the pandemic, there was a sudden surge of seemingly new ‘thematic’ investment funds that came to market worldwide (Morningstar’s data indicates that assets tripled in this space between 2019 and 2021 to roughly US$800B globally). Often structured as an ETF for ease-of-access to the DIY investor, an onslaught of new ideas flooded the market and captured the imaginations of many. These products launched on the notion that an everyday investor will profit off of a global theme that crosses traditional economic sectors, like “Big Data” or “Robotics & Automation", "Blockchain" or (unfortunately a bit close to home) "Cannabis." Although the themes might sound new, the concept of a thematic fund isn't.

Here's the thing though.

When we step back from the facade of storytelling and marketing around the 'next big trend' and think about what it is we're actually investing in, the odds are stacked against the retail investor. When investing in a thematic fund or ETF, you are effectively placing three independent bets (full credit to this concept to my counterpart Ben Johnson, CFA):

- That you've somehow landed on the right theme, amongst hundreds of other other themes.

- That the theme you've picked is investable via a basket of public companies, and that those companies aren't already overvalued.

- You've picked the right manager or index provider to capture and exploit that theme.

When an investor gets all 3 correct, results are indeed phenomenal. Historically, Morningstar's data shows that this is often not the case.

Morningstar Global Thematic Funds Landscape Report 2022

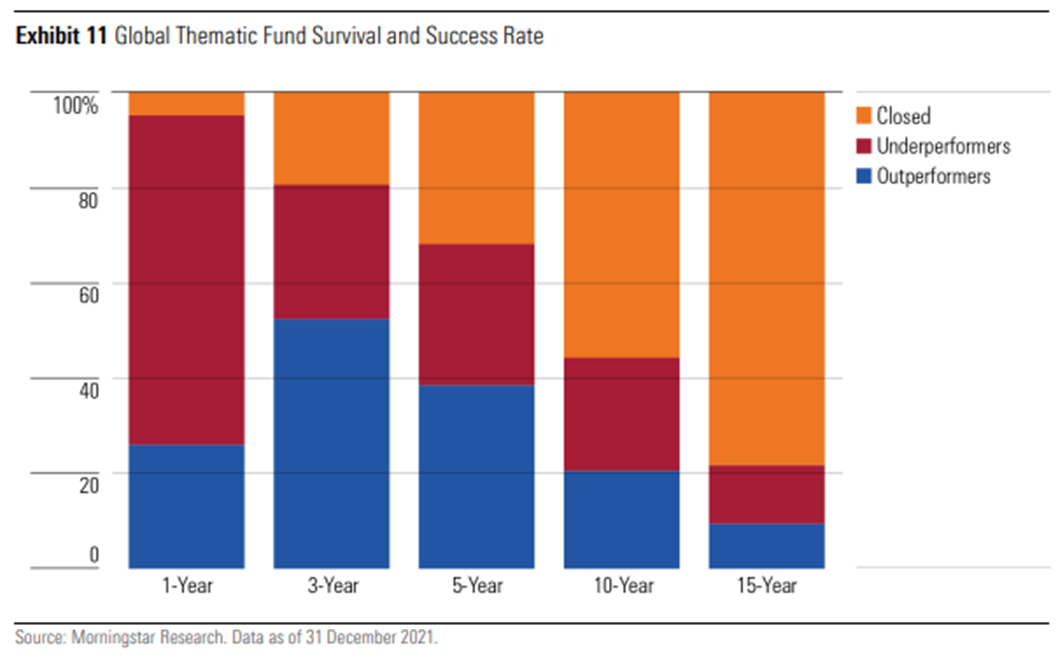

The above chart maps the survivorship rate of thematic funds over last 15 years, ended 2021. It shows that over 5 years, only 39% of thematic funds survive and outperform a broad global equity benchmark (in this case the Morningstar Global Markets Index). Over 15 years, just one in 10 thematic funds survive and outperform.

Discussion