The REAL OAS Deferral Enhancement

In November of 2024, I put forward a poll on both LinkedIn and X, asking the following question:

Is the deferral enhancement for starting OAS at age 70 lower than it is for CPP, higher than it is for CPP, or does it depend? The results thus far from both platforms are as follows:

Let's get to that answer and hopefully learn a thing or two along the way.

Let's start with CPP.

With CPP, you can start taking your pension anywhere between ages 60 and 70. For each month that you begin to take your CPP earlier than age 65, your payment is reduced by 0.6%. For each month later than age 65 that you wait before starting, you receive an enhancement of 0.7%.

The CPP reductions and enhancements are based off the regular payment amount that is calculated if you were to start at age 65. Here is a chart showing how this would work for someone who was entitled to $1,000/mo at age 65.

But wait a second... if instead of starting at 65 and working forward or backward, what if we changed the storyline and looked at the deferral enhancement from age 60, looking forward?

All of sudden we see that the increase from 60 to 61 is actually 11.3%. The base rate matters here. If you are approaching 60 and thinking about CPP, then THIS is how you should be looking at it. Forget about a reduction from 65 backwards, think about the benefit for starting later than 60. If you can wait even 3 years you will get a payment that is 1/3 higher than starting at age 60. Due to the phrasing in the Canadian finance marketplace, most people think that their CPP will only increase by 0.6% per month for each month they postpone their CPP start date beyond age 60, but it's actually much greater than that.

Let's move on to OAS now.

With OAS, you can only start when you are at least 65 (not 60, as with CPP). Like CPP, you get compensated for waiting. However, from age 65 to 70 you only receive a deferral enhancement of 0.6% per month, instead of 0.7% per month with CPP.

Below is a chart that shows how the deferral enhancement works with OAS (amounts indicate the full year payment amounts for the year 2024 for those who qualify for an unreduced OAS pension).

So back to my my poll question, is the deferral enhancement for OAS higher or lower than it is for CPP? Based on the above, most would think the answer would be that the deferral enhancement for OAS (0.6%/mo from 65) is lower than CPP (0.7%/mo from 65 & higher yet from 60).

But there's a twist (of course).

There is a key fact with OAS deferral enhancement, which up until now has largely gone undocumented: You can't really, truly, calculate the OAS deferral enhancement until you know how much of your OAS you are going to keep.

Of course I'm referring to the OAS clawback.

You begin to lose your OAS at a rate of 15 cent for every dollar in which your net income exceeds an income threshold. The income threshold is set annually and increases with inflation. For the year 2024, this threshold is set at $90,997. I commonly refer to this as the clawback floor.

For example, if your net income is $90,998, you would lose 15 cents of your OAS. If your net income is $90,999, you would lose 30 cents. Eventually, you lose it all if your income is high enough.

The math around OAS clawback must be factored in before one can really, truly, calculate their deferral enhancement for OAS.

Let's review by exploring a few examples:

Example 1 - Starting Point (what everyone talks about)

Anyone who (for 2024) has a net income of $90,997 or less will truly have a deferral enhancement of 36% from age 65 to 70.

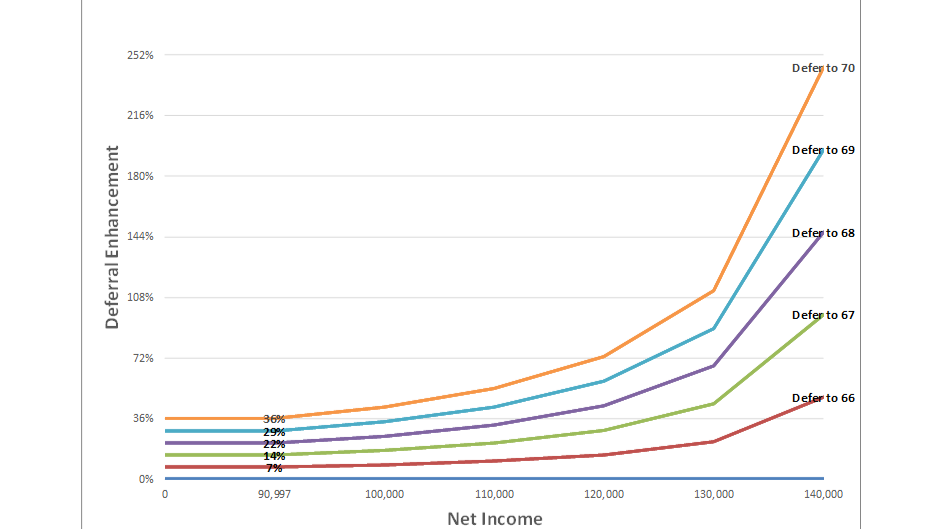

But as net income rises into the clawback zone, you begin to lose your OAS (15 cents/dollar). Due to the way this formula works, the erosion has a larger percentage reduction impact on those who started their OAS at 65 vs. 70.

Let's look at the table below so you can see what I mean.

At a net income level of $125,000, you would have $5,100.45 of your OAS clawed back whether you started your OAS at 65, 70, or anywhere in between. However, as highlighted in yellow, you'd still keep 56.5% of your OAS income if you had started at age 70, but only 40.8% if you had started at 65.

This has a trickle down effect. The trickle down effect is such that the 0.6% per month deferral enhancement does not hold true for those who have income within the clawback range. For those people, the deferral enhancement is greater.

Example 2 - Net Income of $100,000

At this level, the 'real' deferral enhancement for OAS is 42.7% for someone who deferred to age 70 and is currently under age 75 (when payments increase by 10%).

PS - That is higher than the 42% for CPP deferral from 65 to 70.

Example 3 - Net Income of $125,000

Per the below, at $125,000 of net income, the 'real' deferral enhancement for OAS is 88.2% for someone (currently aged 65 to 74) who deferred to age 70.

Interesting. Don't you agree?

Example 4 - Net Income of $140,000

The math keeps going, and as income increases the person who deferred to age 70 is receiving (keeping) an OAS pension that is 244.8% greater than the amount someone would receive who started their OAS at age 65.

Perhaps now (for the first time?) you are properly equipped to fully answer the poll question.

Question: Is the deferral enhancement for starting OAS at age 70 higher or lower than it is for CPP?

Answer: It depends.

It depends on your actual retirement income.

Thanks for reading,

Aaron Hector, CFP, R.F.P., TEP

Discussion