The corporate executor – who, what, where, why, and how much?

When deciding who to appoint as your executor, you’ll likely want a detail-oriented person with a good blend of strong financial and emotional acumen. Maybe the choice is obvious – but maybe such a person just doesn’t exist in your life. Or maybe you need someone with a unique or specialized skillset. What then? Enter the corporate executor.

The idea of using a corporate executor remains a mystery to a lot of people: when or why should you use one and what are the costs? In this article, we’ll explore these questions and hopefully leave you with a better understanding of this often-misunderstood resource.

Why use a corporate executor?

There are several situations where using a corporate executor might make sense:

1. The person you’d like to appoint as executor doesn’t live in the same jurisdiction as you.

2. You operate a business that will need to be managed or sold after your death.

3. Family tensions make it difficult to maintain impartiality, making a third-party executor a more effective option.

4. Your family may include individuals with unique dependency needs.

5. If trusts are established that will be administered by a corporate trustee, the executorship and the trusteeship services will often be provided by the same firm.

6. While some find an executorship appointment to be a great honour, others may find it burdensome. You may not want to put executorship duties on a loved one who would struggle to manage them.

While this is by no means an exhaustive list, you can see there are many valid reasons for considering a corporate executor. Why, then, do so few people choose to use one? The number one reason – and you likely guessed it – is cost.

While it’s true that there are sizeable fees, it still may be worthwhile if your situation involves some of the above-mentioned situations. My main critique of the cost argument is that many people who cite cost as an impediment don’t actually know what the cost is. They don’t know what’s reasonable in the marketplace, how it would be structured, when it would be paid and who would pay it. Let’s explore this further.

Process & fees

The appointment of a corporate executor would occur within your will in the same way you’d appoint an individual. So, instead of naming Jane or John Smith, you’d name a trust company. Outside the will, you would then sign an agreement with the trust company which would outline your agreed upon compensation arrangements for the executorship, and any other services they would provide upon your death. Your will would state that the trust company is entitled to receive renumeration based on the agreement that you’ve previously made with them.

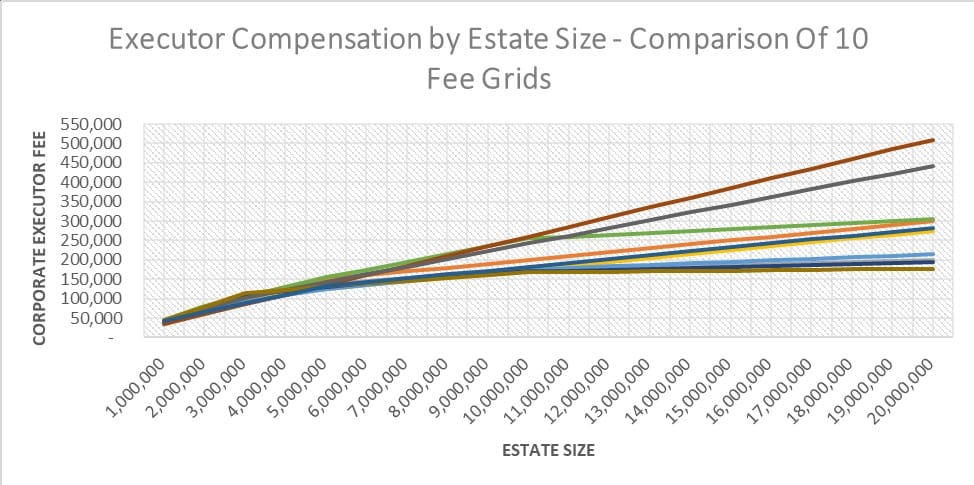

Over the past few years, I’ve reviewed the agreements for most of the major players in this space and I’ve designed a tool to help estimate the costs for my clients. Without naming firms (sorry!), here’s a summary of the findings which are current as of June 2020. Each line represents one of 10 different trust companies, and shows what their fee would be for any given estate size. I have broken out the charts to first show only up to $5 Million of estate value, and then below that I have expanded the chart to show the costs on estates up to $20 Million.

Here are a few of my observations:

- A minimum estate size of $1,000,000 will often apply.

- The average1 fees at $1M, $3M, $5M, $10M and $20M are 4.2%, 3.4%, 2.7%, 2.0% and 1.4% respectively.

- While there is a $10,000 spread between the most cost-effective and least cost-effective fee on a $1M estate, this divergence becomes much more significant as estate sizes get larger.

- The most cost-effective alternative for a $1,000,000 estate is also the least cost-effective solution for any estate over $9,000,000.

- The dotted black lines do not relate to any specific trust company's fee grid. Instead, these represent a suggested fee range that are often sited in Alberta when a Will is silent on executor compensation. This is not legislatively in force, rather, it is often used as a guideline that a friend or family member could use to charge the estate if they were acting as executor. The reason for including this is to point out that it's not a guarantee that using a friend or family member as executor will save the estate any money. Each province would have it's own guidelines or rules for executor compensation.

1Averages omit the highest and lowest figures from the sample set. This helps increase accuracy by avoiding the outlier effect.

There are zero upfront costs associated with this appointment. The executor fees would be collected from your estate after you die, and your beneficiaries would receive the net amount after the executor fees have been collected. What does occur up front is the agreement and, potentially, the negotiation of what that future fee structure will be when you do die.

If you already have a corporate executor named in your will, that word ‘negotiation’ may come as a surprise to you. When a corporate executor is required, it’s common practice for estate lawyers to recommend a specific trust company for you and coordinate the paperwork. However, my experience has been that this process would typically result in an off-the-shelf agreement being signed. This would eliminate the opportunity for you to explain why you should perhaps qualify for a lower-than-advertised rate.

Consider this

The costs associated with corporate executors is as high as it is because the trust company has no way of knowing what they’re getting into, and administering a disorganized and mysterious estate can be very time consuming. They need to price the unknown into their fee models. If you can illustrate to the potential trust company that your affairs are orderly, kept up to date, well documented and, dare I say, “simple”, then there’s a good chance you’ll be able to sign a reduced rate. It doesn’t hurt to shop around a bit.

Other considerations

It’s also important to note that, like naming an individual as an executor, the appointment of a corporate executor is a revocable position. As such, you’re free to change your mind in the future if your situation evolves and you no longer need a corporate executor. Or, if your situation has become less complicated you may be able to negotiate a more competitive arrangement.

I typically recommend to my clients that they have a robust review of their estate documents at least every five years and, if applicable, their corporate executor and trustee appointments would be included in this review process.

While this article has focused on corporate executors, if your estate includes trusts that will need ongoing management then those trustee costs would be in addition to the executor arrangements that have been the focus of this article. While the executor duty is a one-time event, the beneficiaries to your trusts will have an ongoing relationship with any corporate trustee that you may appoint. So, it’s important that you have a solid understanding of the agreements that you have in place for the care and management of your trusts.

In the long term

I hope this has brought you some clarity on when it might be beneficial to use a corporate executor, and that you now feel more equipped to have these conversations with your estate lawyer or financial planner. If your situation could benefit from this expertise, you shouldn’t let the fees persuade you from doing what’s best for you and your loved ones. As with many things, doing a job poorly can be much more expensive and painful in the long term than paying someone to do it correctly the first time.

Discussion