Meet the Average Investor

Before we get to the point where we would start investing client’s money, it’s important to take a quick travel back in time, and look at the investment environment and see what being an investor in the US has looked like over the last 20ish years.

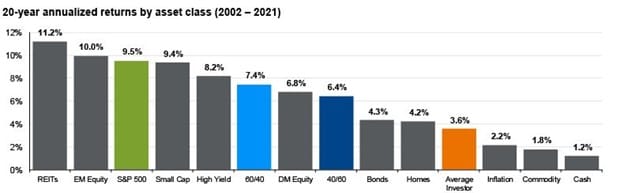

The troubling item I see in the chart above is toward the right side in orange – the returns of the ‘Average Investor’. According to JP Morgan, the ‘Average investor’ in the US earned 3.6% per year while inflation ate away at their wealth by 2.2% per year.

The reality then is that the ‘Average Investor’ could have taken almost any other investment or combination of investments, stuck with it and had a significantly better experience.

Of course, not everyone would have a risk profile suited for a 60/40 portfolio, or a 40/60 portfolio (equities/bonds) – on average however – with everyone involved – it is a reasonable landing spot to keep in our minds.

Click here to find out Who is the ‘Average Investor’?

Discussion