It's Time For a Fiduciary Standard of Care

Creating a fiduciary standard of care in Canada is the next step to ensuring Canadians are protected from bad actors and sales based practices in the financial sector. It would increase enforcement capacity of regulators and enable clients to seek higher damages in court for bad advice. Ultimately, it would weed out bad actors, ensure existing industry participants are held accountable for the advice they give and create a higher standard of trust in the financial services industry in Canada.

There is a big problem with financial institutions and MGAs (Managing General Agencies) in Canada in that most operate on a sales-driven model. The focus here is sell, sell, sell, driven by a salesforce of many under-qualified advisors who misrepresent their qualifications and ethical obligations. Many studies have been done which point to a misunderstanding of regulations, titles and ethical requirements. For example, insurance advisors with solely a sales license are able to sell complex permanent life insurance solutions that cost clients tens and hundreds of thousands of dollars, with little training and no holistic planning requirements. This cannot lead to good outcomes at scale.

Title protection in certain provinces like Ontario, New Brunswick and Saskatchewan have adopted initiatives to regulate titles through title protection to address this issue, but it goes deeper.

I believe it's time to look at a principles based fiduciary standard implemented by regulators in all provinces across the country.

A recent example of systemic anti-consumer policies can be seen in the implementation of Know Your Product (KYP) requirements under Client Focused Reforms. These regulations require that regulated investment and mutual fund advisors present clients with suitable alternatives to their proposed portfolios. However, in response, many big banks have restricted their branch advisors’ access to third-party products, preventing them from offering a wide range of potentially better options for clients. This shelf restriction restricts the advisor's ability to act in the client’s best interest and exposes a clear conflict of interest.

Another example comes from MGAs that hire inexperienced insurance advisors with no financial planning designations to sell complex life insurance products to consumers. Recent investigations found that multiple MGAs use MLM style hiring and incentive practices to recruit new advisors to the industry and sell complex, high commission products without proper training or education.

The insurance salesforce often targets new immigrants to purchase complex, permanent life insurance policies. Many advisors exploit these individuals’ unfamiliarity with Canadian financial systems, sometimes discrediting more ideal government-backed plans like RRSPs and TFSAs to push more lucrative commission-based insurance products.

Young Canadians are often introduced to financial services through big banks or insurance brokers. They lack the knowledge to make informed decisions and are vulnerable to predatory sales tactics. This erosion of trust leads many to seek advice from unregulated, often unreliable sources like social media.

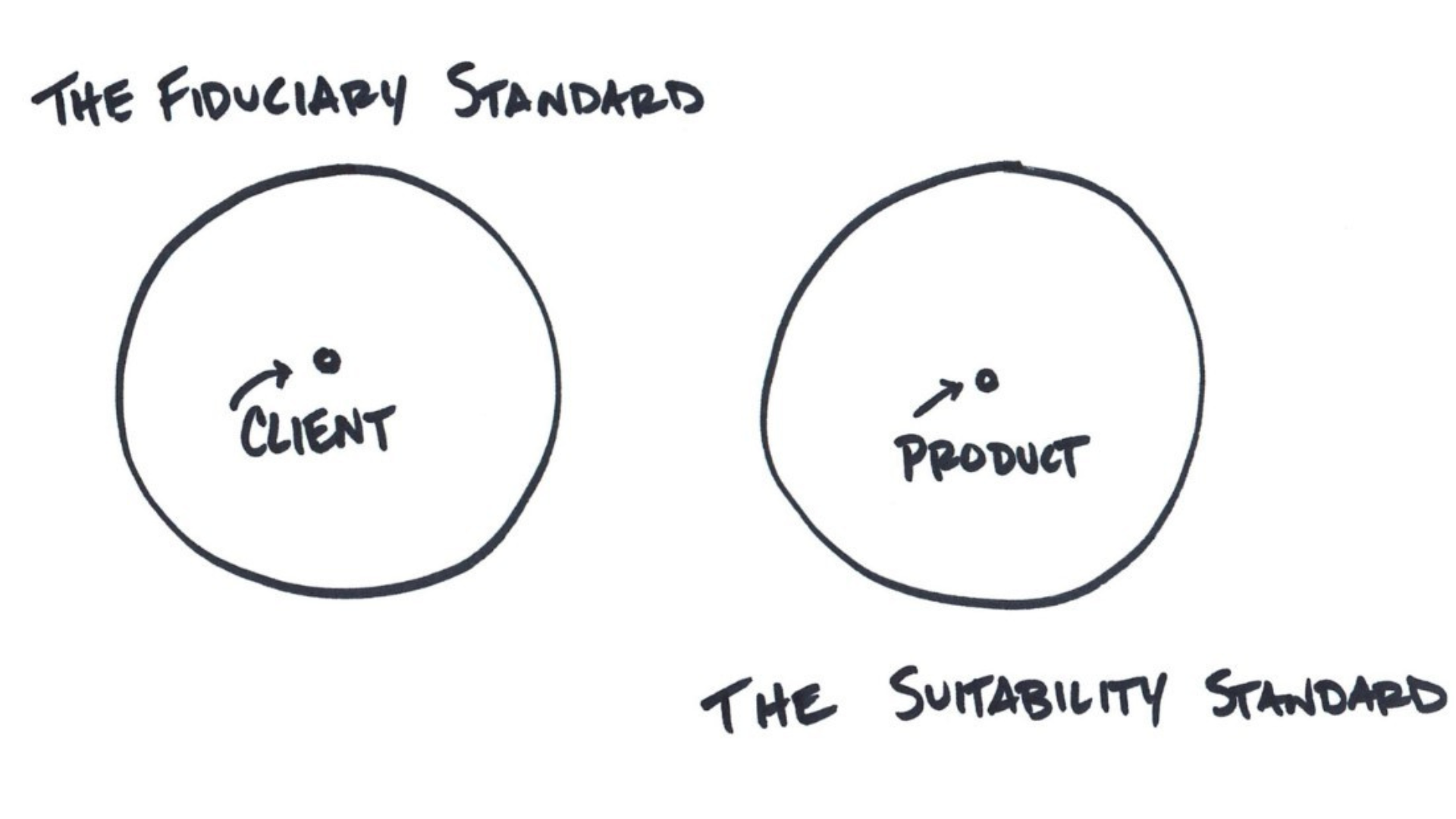

While the path to implementing a fiduciary standard is complex and requires careful consideration, it is clear that the current standards of ethics and duty of care / suitability standards are insufficient to ensure Canadians receive advice that prioritizes their best interests. Clients deserve better.

To address these issues, a principles-based regulatory framework could support firms in improving advisor training. It could guide the industry to reduce commission-based sales incentives, often leading to inappropriate recommendations, and help weed out the worst actors.

Ultimately, Canadians deserve a fiduciary standard to protect their financial well-being and give them greater recourse for when they receive bad advice. It’s time for the industry to evolve and align with the values of competency, ethics, and accountability.

Discussion