Insurance Contracts and Exclusions

Those who follow Aravind Sithamparapillai on Twitter have likely noticed his recent need to claim against his travel insurance.

Getting a real life financial planning lesson in crisis management and insurance.

— Aravind Sithamparapillai (@AravindSitham) August 27, 2024

Daughter has been sick for 3 - 4 days. (Currently on vacay in the Dominican Republic).

Took her to walk-in clinic. Assessment was 205 usd - insurance covers it.

She has to go to hospital. 👇🏾

This led to some conversations about exclusions on insurance policies. I thought it might be useful to explore the concept of exclusions a bit, as I run into a lot of misconceptions here.

For the American readers out there, please don't bring your health insurance into this! I hear all manner of horror stories here. We are talking about the Canadian market, where I would suggest it's pretty rare to run into an unjustified exclusion-based insurance horror story.

First, we should recognize that exclusions are generally a good thing. We all want to be able to purchase insurance for an affordable premium. The insurer has to design coverage that will pay in the most common circumstances, but won't pay to people who have tried to game the system, or to people who represent unusual risks.

There is a substantial amount of information asymmetry when somebody enters an insurance contract. The person buying the insurance has a substantial amount of information, and the insurer has to be careful about what questions they ask and how.

As an example, there is no obligation in Canada to disclose the results of most types of genetic testing to an insurer, but if there are good results, those may be useful to keep premiums low. The decision to disclose most genetic testing results rests entirely with the applicant. This puts the insurer at a disadvantage.

The insurer will partially offset this disadvantage with its access to massive amounts of demographic information. Insurers have access to both public and proprietary data about the likelihood of somebody dying or becoming disabled at any given age, and based on a range of other factors.

The tradeoff between exclusions and the type of coverage is most evident with life insurance policies. A fully-underwritten life insurance policy is what most agents will be most familiar with. In this case, the insurer provides a detailed application to the applicant. The answers to the question in the application will help the insurer determine whether further information is needed.

Based on that information, the insurer may issue a policy. The only standard exclusion on most life insurance policies sold in Canada is a suicide or self-harm exclusion. This exclusion will prevent a death benefit from being paid if suicide is the cause of death in the first two years after a policy is issued, amended, or reinstated after a lapse. (MAID is not considered suicide for this purpose.)

There is no statutory requirement to include a suicide exclusion, and an insurer could issue a policy without it.

We do see lots of life insurance policies issued with exclusions beyond the suicide exclusion, but these additional exclusions only show up where something came up in underwriting to support it. For life insurance policies, lifestyle exclusions are common, but health exclusions are rare.

Travel exclusions, for those who regularly spend a month or more outside Canada, especially in a place with less accessible health care, and mountaineering exclusions, are both common today. If I were applying for life insurance today, I would not have either of these exclusions added, as there would be nothing in underwriting that would suggest these are expected risks for me.

If we think of a spectrum, life insurance policies are at the far end of the spectrum, where almost nothing is likely to be excluded. The opposite end of the spectrum would include policies like travel or accidental death and dismemberment policies. With these policies, underwriting is typically minimal, and the premium paid is typically not enough to justify writing policies with exclusions tailored to the risk of the life insured.

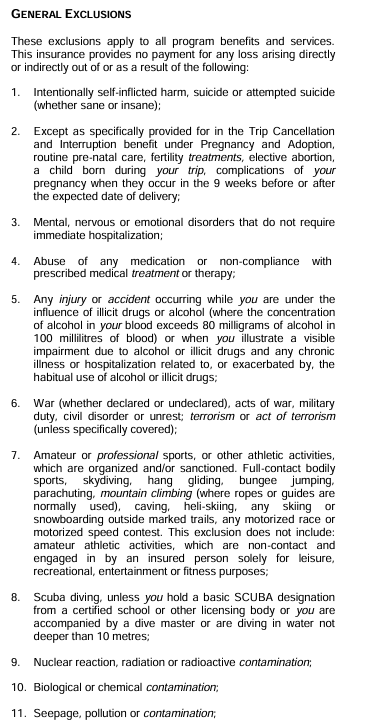

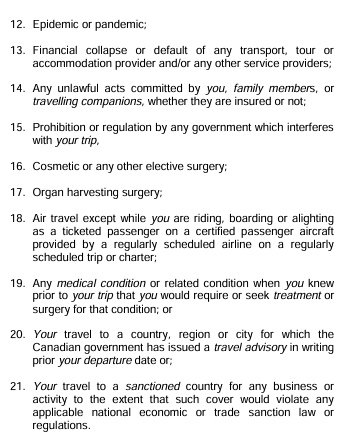

This takes us back to Aravind's Tweet. What's excluded in a travel insurance policy? It turns out that it's much more than what's excluded from a typical life insurance policy. The general exclusions page of a typical policy from a major Canadian travel insurer includes the following:

There are some potential surprises here. Item 5, for example, includes an exclusion for an injury or accident that happens while under the influence of drugs or alcohol. Good thing nobody drinks while on vacation.

Give your policies a read, and see what's excluded.

Discussion