Guide: How to draw down a $100,000 RESP over a 4 year university program.

Parents who have saved in their RESP often have questions about how to best withdraw money out of the account once their child is nearing the age in which they will begin going to post-secondary school. This article will highlight some things to consider and one potential drawdown plan.

First of all, if this sounds familiar, you may be thinking of a previous FP Collective article I wrote last year which outlined a drawdown plan for someone who had $200,000 inside their RESP. That article can be accessed in the link below. When compared to today's article, you will see that the strategies and techniques applied to a $100,000 RESP are different than those for a $200,000 RESP.

But for today, let's focus on how best to drawdown a $100,000 RESP.

First, let's lay out some assumptions and priorities.

Assumption 1 - The costs

Let's assume that the costs are $3,750 for tuition for each semester and $6,250 for living expenses. Over a 4 year program (8 semesters) that is $80,000. If you are wondering where that's coming from, I have loosely based it off this article: https://www.newswire.ca/news-releases/canadians-can-expect-to-pay-an-average-of-75-387-for-a-4-year-university-degree-and-residence-next-year--890092153.html

Assumption 2 - The RESP account composition

Let's assume that the account is worth $100,000. Of that, the account has been funded with $50,000 of contributions. The remaining $50,000 is broken out as $7,200 of CESG (Government grants) and $42,800 of investment growth.

That means that $50,000 can be withdrawn as Post-Secondary Education (PSE) withdrawals. These are a return of your original contributions and are 100% tax-free when withdrawn. The CESG + Growth (remaining $50k) would come out as Educational Assistance Payment (EAP) withdrawals, which are taxable to the student.

This breakout between contributions, grants, and growth is important. You should confirm what your RESP looks like so you can plan accordingly.

Assumption 3 - Growth & Inflation

To keep this simple, I have not included further growth in the account. I have also not factored in cost inflation on the tuition, rent, or living expenses. In reality, there would likely be some growth in the account to offset some cost (and tax bracket) inflation. Hopefully this is a bit of a wash. It was a simplifier I was willing to make to make this article easier to follow.

Assumption 4 - Other Income

Let's assume for the purpose of this article that the student does not have any other income sources from say a part time job, co-op program, summer employment or anything else. If they do, then you'd need to factor that in as well.

Now for the priorities.

Priority 1 - Draw out EAP early

If the student doesn't finish school, you don't want to be left with CESG or growth inside of the RESP account. This is because if there is nobody in school, those amounts which would otherwise have come out as an EAP (the CESG grants and the growth), would then have to be paid out as an Accumulated Income Payment (AIP). When this happens the CESGs have to be repaid to the Government, and the growth in the account becomes taxable to the subscriber (in most cases, Mom and/or Dad) with an additional 20% penalty tax levied. This is a bad result. Therefore, there is an incentive to drawing out EAPs first to try and avoid the likelihood of this situation.

But it's not quite so simple, because we have more priorities.

Priority 2 - Optimize for tax

Plan to keep the student's taxable income around $16,000 if possible, without going over. This is the level of income that can be fully offset by the Basic Personal Amount (BPA) tax credit. In other words, this is the level of income where you'd pay no Federal or Provincial tax.

Yes, students CAN earn a higher level of income than that while paying no tax because they have tuition credits that can be used to offset higher levels of income that exceed the BPA threshold. However, if you can keep the income to $16,000 or lower then the student doesn't NEED to use the tuition credits to pay zero tax.

Keeping the income below the BPA then opens the door for the student to save the tuition credits until they are out of school, and working. This will give them an early tax boost in their early career. Alternatively, up to $5,000 of tuition credits can be transferred to Mom or Dad each year. Your choice.

Yes, choice. There is a lot of confusion about how this works.

The amount of tax savings will be identical whether the student claims the tuition credits (eventually) or Mom or Dad claim them sooner. It's a credit, not a deduction, so the marginal tax rate doesn't matter and the benefit is the same dollar amount. Some parents want to claim the tuition credit transfer so they can use the credit to lower their own taxes. Other parents want to save the credit for their child's future benefit once they are working. There's no right or wrong answer here, it's a family by family choice. However, I'd wager that a lot of parents who make these choices don't fully understand the options.

If the student's income is high enough (beyond the basic personal amount of $16,129 for the year 2025) then they are forced to use the tuition credits, it can't be saved for the future, and it can't be transferred to Mom or Dad. So keeping the student's income below the BPA preserves the tuition credits and opens up the door for this decision to be made.

Priority 3 - Take advantage of the TFSA

As possible, shift money out of the RESP and into a TFSA. This moves the future growth into an account that is 100% tax free. The RESP is good, but the growth is still ultimately taxed to the student upon withdrawal. A TFSA is better as the growth is never taxed to anyone. Shift over as you can. It can still be used for education in the future if it needs to be.

Now that we have our assumptions and priorities laid out. Let's map this out.

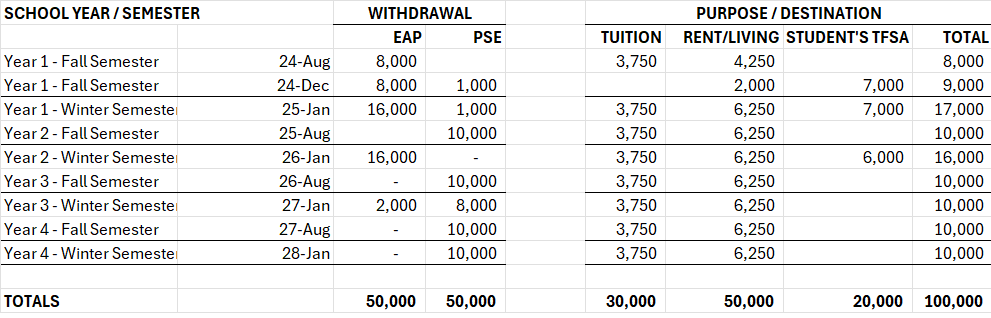

It's August of Year 1 and the Fall Semester will be starting soon... the student has confirmed enrolment. Provide the official letter of enrolment from the Registrar to your RESP promoter (the financial institution where your RESP is held) and request to make a withdrawal of $8,000 as an EAP. That's the maximum amount that can be withdrawn as an EAP during the first 13 weeks of enrolment.

After the first 13 weeks you can withdraw up to $28,881 per year as an EAP with out providing evidence as to why you need that much. This threshold is indexed annually and that is the 2025 amount. (The source for the EAP threshold is here: https://www.canada.ca/en/revenue-agency/services/tax/registered-plans-administrators/bulletins/resp-bulletin-1.html)

If you have a $100,000 RESP and four years to plan out your withdrawals, then it is unlikely you'd need to go up to that annual EAP limit. However, just in case your child decides not to finish their program you might wish to then draw as much EAP out of the RESP as possible so that's an important number to know.

Getting back to the roadmap... You've withdrawn $8,000 as an EAP in August for the Fall Semester of Year 1. That's going to be allocated as $3,750 for tuition, and $4,250 for living expenses for the first couple of months.

Then in December (once 13 weeks in the fall semester have elapsed) you are going to draw out another $8,000 as a further EAP, and $1,000 as a PSE. These amounts are going to be used to provide another $2,000 of living expenses and $7,000 to fund your 18 year-old's first TFSA contribution.

Note that we've stayed at $16,000 of EAP withdrawals ($8k + $8k) for the year to stay below the BPA, for tax purposes. We just had to break it up because of the stipulation around the first 13 weeks.

Then in January of the next year we need to pay for the Winter Semester of post secondary Year 1. The calendar has turned over, it's a new tax year, and we are no longer restricted by the first 13 weeks of the program; so let's withdraw $16,000 from the RESP as an EAP and $1,000 as a PSE withdrawal. That's going to fund tuition ($3,750) and the semester's living expenses ($6,250)... and another $7,000 contribution into the student's TFSA.

In August, we start the Fall Semester of Year 2. We don't want further EAP withdrawals because in January we already took out $16,000. So $10,000 is withdrawn as a PSE ($3,750 for tuition + $6,250 for living expenses).

We continue to carry on like this. We focus on drawing out EAPs early without going over $16,000 per year, we spend what is required on education and living expenses ($80,000 total is allocated here) and we allocate $20,000 into the student's TFSA (which has the flexibility to be used on education related expenses if that proves to be necessary, and if not necessary it could be used to instead fund a FHSA account, if home ownership is more of a near term priority than the flexibility that the TFSA account offers).

When it's all said and done, here is what it looks like:

It's important to note that the withdrawal plans can change, sometimes dramatically, if the account size is different or if the composition within the account (contributions vs. growth vs grants) differs significantly than the example I've provided above. For example, I have previously done a similar breakdown on a $200,000 4-year withdrawal plan which is quite different than this one.

I hope this was a helpful guide to give you some ideas about how to take money out of your RESP. If it was helpful, and you think it would help others, then please feel free to share it.

Thanks for your time and attention!

Aaron

Discussion